Selecting an Executor

Selecting an executor is one of life’s most important expressions of trust and respect. The executor’s duties are a complex distillation of all of the financial responsibilities of a lifetime. In a compressed time frame. With a live studio audience. And most who are tasked with it are doing it for the first time.

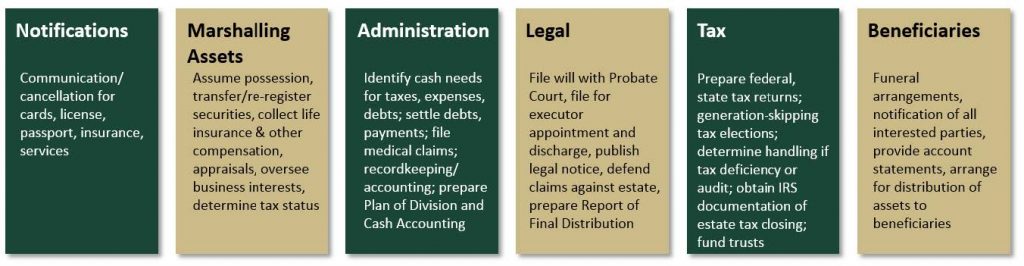

The executor is responsible for initiating the probate process, including getting the court to formalize their assignment. They then inventory and value the estate’s assets, pay bills, liquidate investment accounts, sell real estate and vehicles, cancel credit cards, pay off loans, and distribute remaining assets to the beneficiaries according to your will and trust documents. They may even be asked to manage your final arrangements.

Importantly, the executor is considered a “fiduciary,” which means they have a legal obligation to act in the best interests of those who will be affected by your will.

It’s daunting, making your selection and preparation of the appropriate person is equally daunting. So, let’s review some of the issues you may encounter.

EXECUTOR DUTIES

For more on the duties see our white paper, So Now You’re an Executor.

QUALITIES TO CONSIDER

A few are self-evident. Legally an executor must be a U.S. citizen, of age, with no felony convictions in their past. They must be willing to serve in the role and yes, you would be shocked by how often executors only learn of their “assignment” after the principal’s death.

You should have a good reason to believe they will outlive you, and it is important to name a backup or successor in the event your chosen executor passes away before undertaking or completing their duties.

That aside, let’s talk about the right person. When you think about the skills necessary, they include a challenging mix of administrative and interpersonal (bordering on political). The administrative aspects require a high degree of discipline. Good time management skills. Organization. Comfort with technology is helpful, for example, familiarity with spreadsheets and access to a scanner.

Of particular importance is the ability to record-keep the status of the project and all of its pieces, because settling an estate is a start-stop-start-stop process that requires the executor to proceed efficiently even when only able to work on it intermittently. If they can’t find the title to your car when they need it, the 45 minutes it should take to track it down could turn into a day or two before the task gets completed. It adds up.

Also, key is good judgment and a willingness to do some research or ask for help when it’s unclear how to proceed, which will be often.

Be careful before naming a spouse or family member. When the time comes their grief could be incapacitating or create delays that will become a problem you never intended. Or age or health issues may emerge over the years that make the task too much of a burden. And the tasks can be unpleasant, like collecting loans that might be outstanding with friends or relatives, or retrieving borrowed items.

And finally, a quality so obvious that one hesitates to even mention it – trustworthiness. Your executor will have access to information and material unlike perhaps anyone else in your life, while also being required to represent the best interests of your beneficiaries. It is a tall order.

Use conflict avoidance as your guide. If you put the proverbial bull in your china shop, the damage done can be permanent when you’re no longer there to referee.

COMPENSATION

Your executor will be entitled to compensation. You may stipulate any amount or calculation basis you wish, spelled out in the will. If your will is silent on the issue, a calculation will be based on state-specific laws.

For example, Florida applies a sliding scale, from 3% on the first $1 million in estate value, to 1.5% on $10 million and above. In New York, the fee is based on the amount of money the executor receives and pays out (essentially the value of the probate estate) from 5% on the first $100,000, to 2% on sums over $5 million.

Some will waive the fee, or indicate an intent to waive it – at least until they realize how much work is involved! If you have beneficiaries who may have issues with executor compensation, do your executor a favor and front-run this for them. Aside from communicating your directive personally to beneficiaries, it’s not a bad idea to also spell it out in the will for all to see.

CO-EXECUTOR AND CORPORATE EXECUTOR

The larger and more complex the estate, the more likely the appointment of an individual or corporate co-executor. Co-executors could, for example, be a pair of family members who can split the burden. More likely, it will mean hiring a professional to take on most of the heavy lifting. Many law firms and banks offer this service, including Fieldpoint Private. They can be a resource to inventory the assets and handle the valuations. They can make sure all the necessary bills and insurance get paid, terminate the credit cards, file tax returns, issue monthly beneficiary statements etc. And then, ultimately, they can handle the asset sales and the distributions to the beneficiaries. More importantly, they are professionals who do this for a living; they can handle complex issues, be dispassionate, and are not learning on the job.

EXPECTATIONS AND PREPARATIONS

If your executor has not performed the role before, they will need your help in setting their expectations. First, they should know that the settlement process can take up to three years, sometimes longer, depending on complexity. A briefing on the scope of the estate and the locations of key resources and documents (particularly the original, non-photocopied will) will also be helpful. This should include an overview of what has and will be communicated to beneficiaries regarding your executor’s assignment and powers.

Also, set expectations with the beneficiaries. They should know that in addition to being entitled to compensation, you expect your executor to use (and pay for) legal work as well as tax, accounting and other services as relevant. This is an area where resentments can come into play, as some beneficiaries will feel the executor is simply spending their money to make their own life easier.

If you wish for your executor to handle your final arrangements (services, burial or cremation) and perhaps a paid obituary and a gathering of friends and family), make your wishes explicit and in writing. This is another area ripe for confusion or resentment. Arrange for your documented wishes to be shared as needed, and make sure an immediate source of cash will be available for short-term expenses.

You may have other duties in mind for your executor; if so, it is a good idea to write them down and review them with estate counsel. This is because executors’ powers are limited by state law, so if you expect your executor to need certain powers that would otherwise be restricted by law, you need to write those into your will. Depending on your state this might include the power to hire an attorney, a corporate executor or some other type of advisor, negotiating copyrights, or the power to lease a property or to pledge assets to borrow money for estate expense.

Putting these powers and expectations in your will (or a letter of instructions) will also come in handy in communicating to beneficiaries that your executor is doing the work you asked of them and not simply serving their own interests.

Be mindful that courts require that all beneficiaries receive a full accounting of the assets and distributions. They will see your executors’ work. If there’s something that will surface that will confuse or frustrate a beneficiary, don’t burden your executor with it. Tell the affected parties yourself.

GIVE THEM A HEAD START

Finally, familiarize yourself with Fieldpoint Private’s Our Financial Life book and process. Our Financial Life is a records-gathering organizer that will help you capture the essential information that will be needed by those settling your affairs. Your Fieldpoint Private Advisor can work with you to assemble it. It will capture everything from who to call, in what order, at what number and with what purpose; where to find your original signed will; every financial account and log-in; the password to your cell phone; even the log-ins that will let them take down your social media accounts.

About Fieldpoint Private

Fieldpoint Private is a boutique private banking firm established at the onset of the financial crisis by 31 individuals including former Chairmen and CEOs of some of the most well-known and successful financial and consumer firms in America. Their intent was not to craft a firm that would emulate the large, established institutions, but to serve as an alternative. Dedicated to meeting the comprehensive financial needs of highly successful individuals, families, businesses and institutions, Fieldpoint Private offers a powerful combination of private personal and commercial banking services directly and in partnership with our clients’ most trusted advisors. In 2021, Fieldpoint Private founded Fieldpoint Private Trust, increasing the breadth of capabilities available to serve our clients in both sole trustee and co-trustee capacity.

© 2024 Fieldpoint Private. Banking services by Fieldpoint Private Bank & Trust. Member FDIC.

Trust services offered through Fieldpoint Private Trust, LLC, a public trust company chartered in South Dakota by the South Dakota Division of Banking.