Intentionally Defective Grantor Trust (IDGT)

For many wealthy families, the lifetime gift tax exemption will cover only a fraction of the assets that will eventually be transferred, so a great deal of effort goes into techniques that will move assets out of the taxable estate without relying on this exemption.

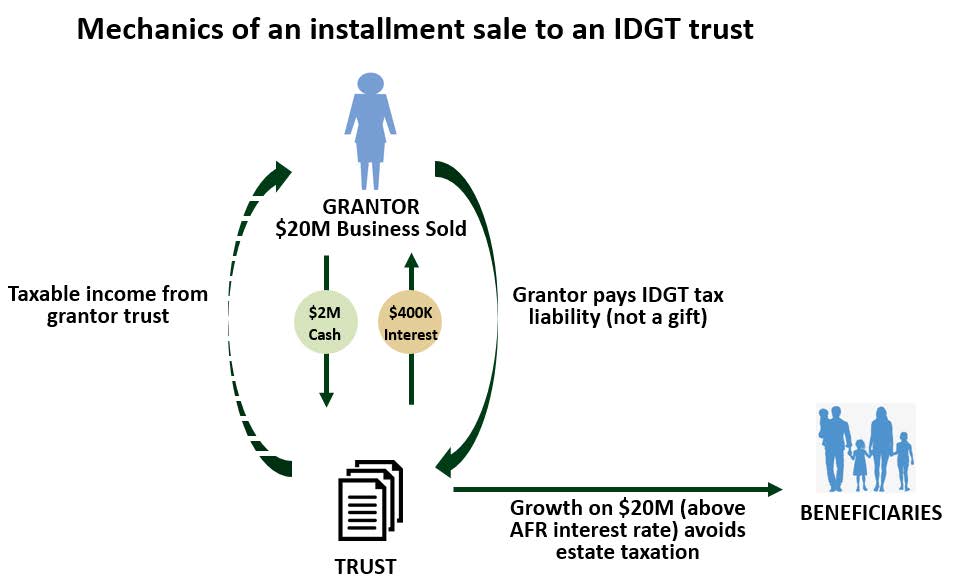

Enter the hyper-technically named intentionally defective grantor trust (IDGT), a strategy that works somewhat like a GRAT (learn more), but is more flexible. The IDGT is not constrained by your gift tax exemption because, technically, you are not “gifting” the assets. Instead, you are setting up a trust and selling the assets into it. In return, the trust compensates you with a promissory note entitling you to a stream of payments, the size and duration of which you will have calibrated with your advisor.

ASSET FREEZING

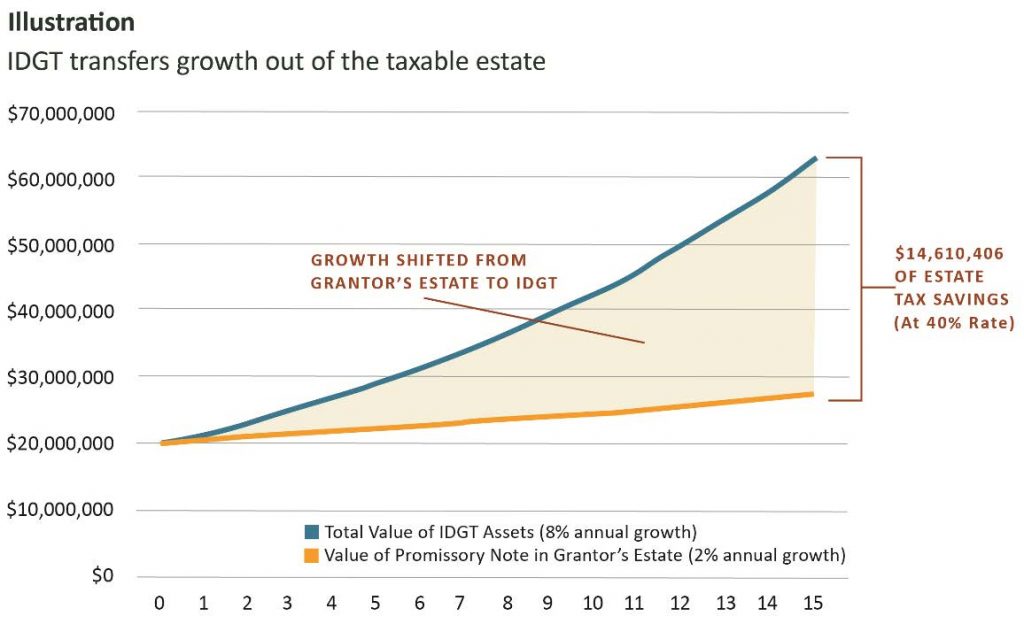

This effectively “freezes” the asset in your estate at its current appraised value. Any appreciation above this freezes level transfers to your children and is not subject to gift and estate tax. So, the key to the success of this strategy is to sell to the trust assets that are either currently undervalued, have strong intrinsic growth potential, or both.

The stream of payments from the trust back to you must include interest, the minimum rate of which is set by the IRS. The technical term for this rate is the “Applicable Federal Rate” (AFR). It changes monthly and is driven by commercial market rates. As the AFR establishes the minimum interest payment, the lower that rate, the less interest is paid out, leaving more remaining in the trust for your children. As such, IDGTs are most effective in low-rate environments. Importantly, once an IDGT is created the rate at that time is locked in for the full term of the loan.

INTENTIONALLY DEFECTIVE?

The trust is deemed “defective” because the Internal Revenue Code does not see it as a separate income tax payer, so while income earned in the trust is taxable to you, interest on the installment payments and any capital gains on the sale of the property to the trust are viewed simply as payments to yourself, therefore not taxable.

While an IDGT lets you remove assets from your estate with minimal effect on your remaining lifetime gift tax exemption, it also lets you take advantage of an exemption that extends beyond your lifetime – the generation-skipping tax (GST) exemption. A Dynasty Trust (see our spring, 2018 white paper) could be an ideal beneficiary of this strategy.

CONSIDERATIONS

CONSIDERATIONS

Along with the IDGT’s considerable benefits come a few things you will want to keep in mind. First, it is, for the most part, irrevocable. However, with proper planning, you may design it so future adjustments can be accommodated if circumstances change.

Secondly, the assets you place in it may not perform as anticipated, yet the trust will still have to honor its obligation on the note. Moreover, without asset appreciation, the strategy itself will not have succeeded. Having said that, most IDGTs have a provision that allows the grantor to reacquire assets from the trust and substitute them using other assets of equivalent value.

Finally, the IDGT will require the counsel of an estate planning attorney, the drafting of the trust, and a valuation of the asset. So, there is a bit of complexity here.

If you would like to learn more about IDGTs and other techniques that might be applicable to your circumstances, talk to your Fieldpoint Private advisor about a complimentary estate plan review.

COMPLIANCE DISCLOSURE

Not approved for client use. This material is intended solely for the information of those to whom it is distributed by Field-point Private. No part of may be reproduced or retransmitted in any manner without prior written permission of Fieldpoint Private. Fieldpoint Private does not represent, warrant or guarantee that this material is accurate, complete or suitable for any purpose and it should not be used as the sole basis for investment decisions. The information used in preparing these materials may have been obtained from public sources. Fieldpoint Private assumes no responsibility for independent verification of such information and has relied on such information being complete and accurate in all material respects. Fieldpoint Private assumes no obligation to update or otherwise revise these materials. This material does not purport to contain all of the information that a prospective investor may wish to consider and is not to be relied upon or used in substitution for the exercise of independent judgment and careful consideration of the investor’s specific objectives, needs and circumstances. To the extent such information includes estimates and forecasts of future financial performance, such estimates and forecasts may have been obtained from public or third-party sources. Fieldpoint Private has assumed that such estimates and forecasts have been reasonably prepared on based on the best currently available estimates and judgments of such sources or represent reasonable estimates. Any pricing or valuation of securities or other assets contained in this material is as of the date provided as prices fluctuate on a daily basis. Past performance is not a guarantee of future results. Fieldpoint Private does not provide tax or legal advice.

Wealth management, investment advisory, and securities brokerage services offered by Fieldpoint Private Securities, LLC. Such services and/or any non-deposit investment products which ultimately may be acquired as a result of Fieldpoint Private’s investment advisory services:

ARE NOT FDIC INSURED – ARE NOT BANK GUARANTEED – MAY LOSE VALUE

© 2020 Fieldpoint Private. All rights reserved. Banking Services: Fieldpoint Private Bank & Trust. Registered Investment Advisor: Fieldpoint Private Securities, LLC is a SEC Registered Investment Advisor and Broker Dealer. Member FINRA, SIPC.