Charitable Remainder Unitrust (CRUT)

WHAT IS A CRUT?

A charitable remainder unitrust (CRUT) is an estate planning strategy often of particular interest to those who hold appreciated, low-basis assets and have, among their objectives, the wish to diversify their holdings while continuing to defer capital gains, generate income tax-efficiently, and potentially leave a significant gift to charity. That’s a wide range of benefits, which is why the CRUT is sometimes called the Swiss Army Knife of wealth transfer strategies.

HOW DOES IT WORK?

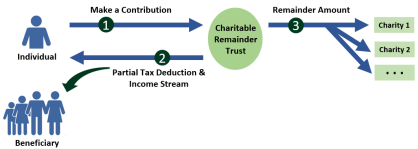

A CRUT is an irrevocable trust that is created for a period of time, either single or joint lives, or for a fixed term of up to twenty years. Once the trust is created, assets — ideally high-value, low-basis — are contributed to it. At the date of the gift, the donor (who can also be the trustee) becomes entitled to a charitable income tax deduction equal to a percentage of the value of those assets (more on that percentage, below).

Once appreciated assets are contributed, for example, a concentrated position in a single low-basis security, they can be sold by the trust, then reinvested gross of tax for diversification purposes. No tax is immediately payable, because the trust is a charitable entity.

From the year of the creation of the trust until it terminates, the person creating it (or anyone else named) is entitled to a tax-favored (more on this later) annual income stream from the trust. This stream is calculated as a percentage of the value of the trust’s assets at the end of the prior year, according to certain IRS rules. This calculation is important to understand and central to the trust planning process; we will explain it below. But in any event, if the portfolio within the trust appreciates, so does the annual income stream.

Finally, at the end of the trust’s term, the remaining value in it (and this is the “remainder” part of a CRUT) goes to one or more named charities.

SOME NUTS & BOLTS

The annual distribution to the income beneficiary, who is chosen when the trust is created, must be between 5% and 50% of the CRUT’s assets and also provide a 10% minimum actuarially determined remainder amount to the charity at its end.11 Whether that remainder is 10% or higher is up to you as the grantor and will affect you in certain ways that you will want to consider in the planning process. In general terms, the higher the distribution percentage, the lower the charitable income tax deduction and amount remaining for the charity. Conversely, the lower the percentage, the higher the income tax deduction, and the more that will potentially remain for the charity. Note also, in CRUTs created for the term of a life or lives, the older the grantor, the lower the income distribution will compute to be, because of the 10% remainder-to-charity requirement.

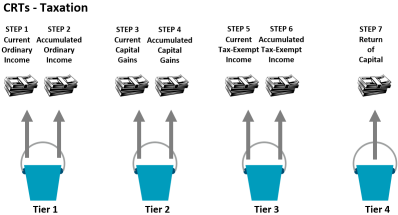

And there are tax benefits associated with these distributions, as well. As illustrated by the diagram to the right, your distribution is sourced from an IRS-stipulated series of five “pools” in the trust. Your distribution, which again is sized to satisfy your annual distribution requirement, is first taxed as ordinary income until that pool is exhausted, then onto the next, and so on.

These pools are 1) ordinary income, such as dividends & interest; 2) short-term capital gain; 3) long-term capital gain and 4) tax-free income such as municipal bond interest, and finally 5) principal.

So what is the tax advantage? If you contributed a large, low-basis position and it is sold in the CRUT, and the proceeds are then invested mindfully, much of the annual distributions will be taxed at long-term capital gains rates, until that pool is exhausted. The charitable deduction will never be equal to 100% of the assets contributed. That is because it is computed2 as the present value of the remainder to the charity. In practice, it tends to run at about 30-40% of the asset contributed. And whatever the amount, it is subject to the standard percentage of adjusted gross income (AGI) annual limitation.

1 Based on the initial fair market value of the trust’s assets.

2 Using IRS annuity tables incorporating the age of the donor and the percentage of the distribution.

VARIATIONS ON A THEME

There are other versions of Charitable Remainder Trusts. Some of the more popular are:

- Charitable Remainder Annuity Trust (CRAT) – A CRAT is similar to a CRUT, the difference being that the annual distribution is a fixed dollar amount as opposed to the variable (based on the market value of the trust assets) distribution from a CRUT. It might be used when a person wants a fixed, predictable income stream.

- Net Income Make-Up Charitable Remainder Unitrust (NIMCRUT) – In this variation, if the trust income (as opposed to capital gain) does not equal the CRUT’s annual percentage payout, the trustee need only pay that lower amount. At the same time, the unpaid amount of the distribution accumulates and is available for payout in later years, when the annual income in the trust has increased….hence the “Make-Up” part of the name. This is often used as a retirement planning strategy and is accomplished by initially investing the trust’s assets in high-growth strategies that produce low or no annual income; at retirement, the allocation is shifted to high-income-producing assets. This allows distribution of the full unitrust percentage amount, plus more, because of the make-up provision.

- Flip CRUT – This final variety begins life as NIMCRUT and then, when the illiquid asset with which it was originally funded is sold (the “flip”), becomes a standard CRUT. This allows no distributions in the early years because there is no income, and then annual distributions after the flip, based simply on asset levels with no dependency on increased levels of income.

Clearly, the CRUT, for all its benefits, is considerably complex. It will require the counsel of an estate planning attorney and tax professional, along with guidance from your Fieldpoint Private advisor. If you would like to learn more about CRUTs and other techniques that might be applicable to your circumstances, talk to your Fieldpoint Private advisor about a complimentary estate plan review.

About Fieldpoint Private

Fieldpoint Private is a boutique private banking firm established at the onset of the financial crisis by 31 individuals including former Chairmen and CEOs of some of the most well-known and successful financial and consumer firms in America. Their intent was not to craft a firm that would emulate the large, established institutions, but to serve as an alternative. Dedicated to meeting the comprehensive financial needs of highly successful individuals, families, businesses and institutions, Fieldpoint Private offers a powerful combination of private personal and commercial banking services directly and in partnership with our clients’ most trusted advisors. In 2021, Fieldpoint Private founded Fieldpoint Private Trust, increasing the breadth of capabilities available to serve our clients in both sole trustee and co-trustee capacity.

© 2024 Fieldpoint Private. Banking services by Fieldpoint Private Bank & Trust. Member FDIC.

Trust services offered through Fieldpoint Private Trust, LLC, a public trust company chartered in South Dakota by the South Dakota Division of Banking.